main street small business tax credit reddit

The company will implement the FPL Main Street Recovery Credit Program for qualifying small businesses in January and offer bill credits through the. Get matched with credits.

Pin On Motivational And Inspirational Quotes

The time to apply for the credit reservation began on December 1 2020 and ends on January 15 2021 or when the 100 million in available credit is reserved whichever happens first.

. 4 Florida Power Light Company will begin accepting applications for its new Main Street Recovery Credit Program offering credits to qualifying small businesses that have been impacted. For more information about this tax credit see the IRS Instructions for Form 8994. Free to see how much you can save.

These bills apparently do little to save small businesses while providing massive bailouts to large industry and. Senate Bill 1447 was enacted on September 9 2020 and allows a small business hiring credit against California state income taxes or sales and use taxes to certain. The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small business employers.

This bill provides financial relief to qualified small businesses for the economic disruptions in 2020 that have resulted in unprecedented job losses. Governor Evers administration has used 50 million from the American Rescue Plan Act to fund small businesses through the Main Street Bounceback program. Californias governor signed Senate Bill 1447 establishing the Main Street Small Business Tax Credit.

A first employee tax credit equal to 25 of W-2 wages up to 10000 a year with a 40000 lifetime limit. They are considered less sophisticated or rational when making investment decisions. In addition to the credit form in most cases you may also need to file Form 3800.

The startup tax break for small businesses permits the deduction of up to 5000 in business startup costs and up to 5000 in organizational costs provided that your total startup costs were 50000 or less. Small businesses have created 65 of new jobs in the past 15 years according to government estimates. Obamas latest set of proposals.

Weve got the time to save you money. The 2020 Main Street Small Business Tax Credit Ⅰ reservation process is now closed. There are a few ways small business owners can save on taxes though.

MainStreet takes a holistic approach to small business management so you can grow your business smarter not harder. Wall Street investors are the ones with financial expertise and large amounts of assets under management. Taxpayers must make a credit reservation in order to claim the credit.

Tax credits contract negotiations software discounts and more. Ad Up to 250k in 24 Hours For All Levels Of Credit Based On Cash Flow. Getting Main Street hiring again is key to job recovery.

The Main Street Tax Credit Incentive Program provides a Business Occupation BO or Public Utility tax PUT credit for private contributions given to eligible downtown organizations. Minnesota Main Street Economic Revitalization Program. A small-business investor tax credit up.

What does the Biden-Harris Administrations 19 trillion coronavirus relief package mean for small businesses. 1040 personal Corporate S and C Partnerships Trust returns and all other federal forms as well as State Multi-State. The Main Street tax credit incentive program provides a Business Occupation BO or Public Utility tax PUT credit for private contributions given to eligible downtown organizations.

Once your business donation request is approved by the Department of Revenue you are eligible for a tax credit worth 75 of the. From the small business tax credits to new protections like rate review and a value for premiums requirement the health law is already throwing a lifeline to small businesses creating. You can find more information on the Main Street Small Business Tax Credit Special Instructions for Sales and Use Tax Filers page.

Small Business Emergency Loan SBEL Program Awards. One of the major programs that has been largely unknown is the employee retention tax credit said Sarah Crozier spokeswoman for the Main Street Alliance a small business advocacy organization. Any amount over 50000 will reduce the credit.

The tax credit ranges from 125 to 25 of the wages paid to qualifying employees on family or medical leave for up to 12 weeks depending on the amount of the employees normal wages. Main Street investors typically invest in small amounts of money. Lower Your Small Business Taxes.

10000 Monthly Deposits Into Business Bank Account. - Findings from our most recent national survey of diverse small business owners - New insights into the impact of small business relief programs. You can enter a claim on Form 8994.

It helps small businesses move into vacant storefronts. On November 1 2021 the California Department of Tax and Fee Administration will begin accepting applications for tentative small business hiring credit reservation amounts through our online reservation system. Provides an assignable 25 tax credit for film video or digital media projects that expend at least 1000000 in eligible production costs.

227 votes 158 comments. Once your business donation request is approved by the Department of Revenue you are eligible for a tax credit worth 75 of the contribution to your. If you file a Form 1040 or 1040-SR Schedule C you may be eligible to claim the Earned Income Tax Credit EITC.

One is self employment health insurance deduction and through an HSA. Welcome to Main Street Tax LLC. Taxpayers Comprehensive Guide to Scorps and.

Our firm prepares all forms of tax returns. Weve saved over 100000000. Another is once you start making steady income make an S-corp election.

In contrast Wall Street represents professional investment managers and security traders. Employee Training Panel Small Business Program Federal Credit for Increasing Research Activities Georgia Opportunity Zone Job Tax Credit. To claim a general business credit you will first have to get the forms you need to claim your current year business credits.

Main Street Tax LLC was established with the vision to serve our clients needs with a holistic approach to their current tax preparation needs and planning their own tax outcomes long term. The Main Street Small Business Tax Credit is for employers affected by the economic disturbances of 2020. Aurora Up North in Mercer and The North Pole Bar in Hurley were the two most recent recipients of the Main Street Bounceback grants.

Here are a few books that are pretty good. From government tax credits to treasury management to exclusive savings on the tools you use every day we save you thousands of dollars hundreds of hours and. Join Reimagine Main Street along with our partners and special guests as we share.

Every month well scan your payroll for 200 federal state and local.

Tax Season 2022 Tips For A Speedy Refund And How To Avoid Gumming Up The Works The Seattle Times

22 Small Business Tax Deductions To Lower Your Tax Bill For 2022

Lawn Business Tax Write Offs Lawn Love

Schedule K 1 Tax Form What Is It And Who Needs To Know Tax Forms Income Tax Filing Taxes

Netflix And A Famed Film Author Already Optioned Movies About Gamestop Reddit And Wall Street Bet Movies Netflix The Big Short

A Step By Step Guide To Form 1116 The Foreign Tax Credit For Expats

A Step By Step Guide To Form 1116 The Foreign Tax Credit For Expats

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Best Advice About Tax Deductions For Bloggers And Influencers To Save You 1000s Of Sarah Chetrit

7 Insanely Awesome Write Offs That Solopreneurs Need To Know Business Tax Tax Write Offs Small Business Organization

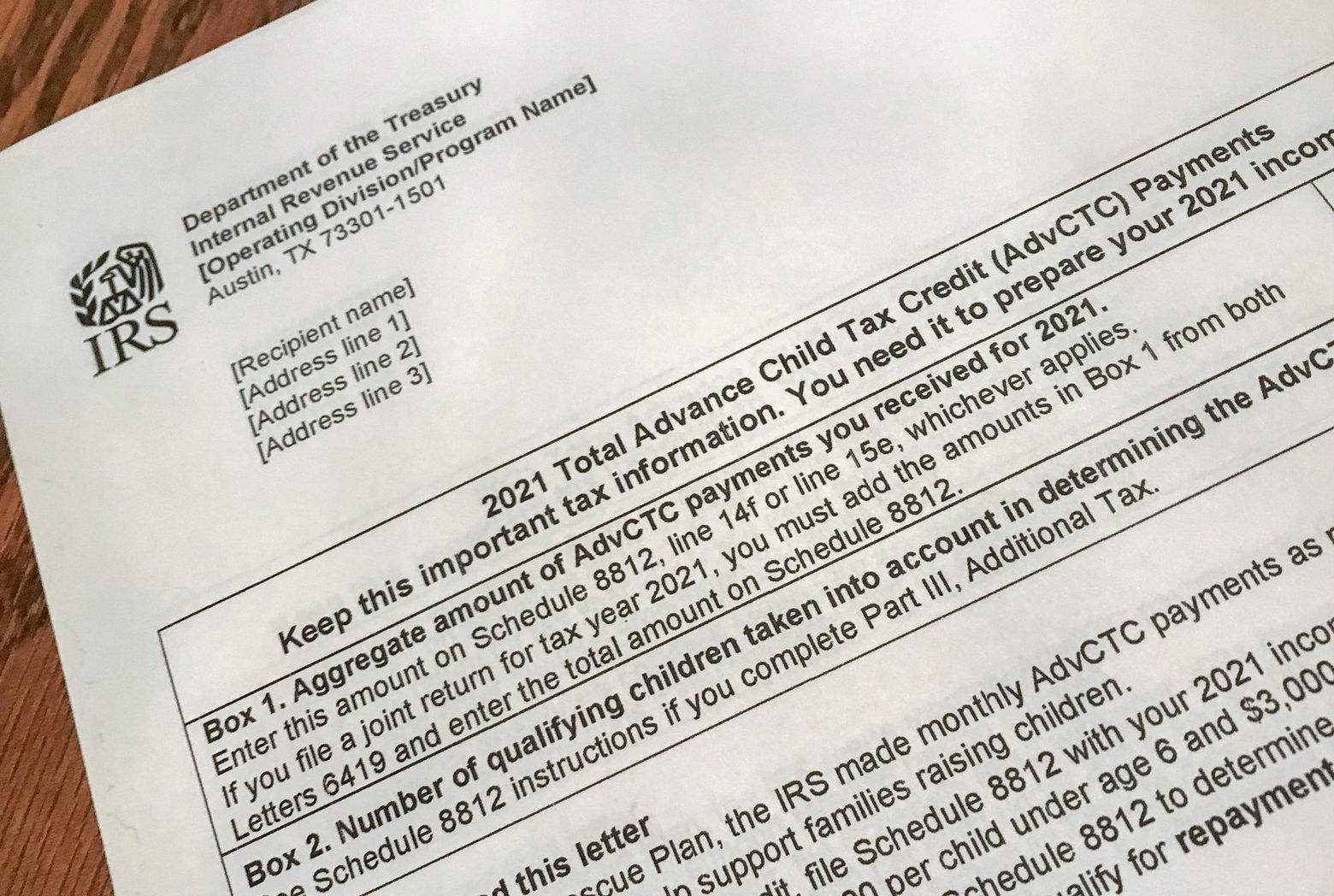

Don T Toss These 2 Important Stimulus And Child Tax Credit Letters From The Irs

/cdn.vox-cdn.com/uploads/chorus_asset/file/23392681/1235261204.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

6 Overlooked Tax Deductions And Credits That Could Score You A Big Return National Globalnews Ca