pay indiana unemployment tax online

If based on your answers to the certification questions you are eligible for benefits that week typically you should receive your benefits. However all locations are currently closed due to COVID-19.

2021 Unemployment Benefits Taxable On Federal Returns 13newsnow Com

La Igualdad De Oportunidad Es La Ley Equal Opportunity EmployerProgram Auxiliary aids and services are available upon request to individuals with disabilities.

. If you are an employer with an existing SUTA account number be sure to check the Yes option button on the first screen you see after clicking New User on the ESS logon screen. Claim a gambling loss on my Indiana return. Your browser appears to have cookies disabled.

Pay Taxes Electronically The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e-services portal INTIME and via Electronic Funds Transfer EFT. Pay online quickly and easily using your checking or savings account bankACHno fees or your debitcredit card fees apply through INTIME DORs e-services portal. Dwd may also garnish the claimants wages once the claimant finds employment.

Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions. Checkingsavings account or 2 a Key2Benefits prepaid Mastercard. Please use the following steps in paying your unemployment taxes.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Select the Payments tab from the My Home page. Large employers more than 200 employees also have the option to report using electronic media such as CDs or DVDs.

You have reached Indianas one stop shop for Unemployment Insurance needs - for Individuals who are Unemployed and for Employers. Bank Account Online ACH Debit or Credit Card American Express Discover MasterCard or Visa from the Make Payment page. Any wages in excess of 9500 are exempt from this tax.

Claimants can now choose between. The tax rate that businesses pay on the first 9500 for each employee varies. Ad Pay 0 to File all Federal Tax Returns No Upgrades 100 Accurate.

Cookies are required to use this site. Logon to Unemployment Tax Services. More information is available in the Electronic Payment Guide.

Pay indiana unemployment tax online. Ad Access Tax Forms. Retrieve information about the Kentucky Unemployment Insurance program.

Payment Plan Set up a payment plan online. Complete Edit or Print Tax Forms Instantly. You can apply for Indiana unemployment benefits online.

1 Direct Deposit to a US. Whom to contact about Indiana unemployment benefits. Claimants can make this payment choice when they login to Uplink Claimant Self Service CSS.

Unemployment Insurance Employer Handbook. Create an account on Uplink CSS Indianas benefits system to submit your claim. Find Indiana tax forms.

Have more time to file my taxes and I think I will owe the Department. Unemployment Tax Payment Process. Currently businesses pay this tax on the first 9500 it pays each employee.

Select Payment Category Please make a selection from the menu below to proceed. All payments are processed immediately and the payment date is equal to the time you complete your transaction. You do not need to create an INTIME logon to make a payment.

Employers paying by debit or credit card should authorize 9803595965 and 1264535957. Pay Taxes Electronically Customers can quickly and securely pay their taxes electronically. Pay my tax bill in installments.

Electronic Payment debit block information To prevent payments from being returned bounced employers paying by e-check should notify their banking institution that electronic payments from T356000158 are authorized for Indiana SUTA payments. DWD recommends that reports be filed online. Pursuant to 20 CFR 60311 confidential claimant unemployment compensation information and employer wage information may be requested and utilized for other governmental purposes including but not limited to verification of eligibility under other government programs.

INBIZ Indianas one-stop resource for registering and managing your business and ensuring it complies with. Know when I will receive my tax refund. 2022 Updates and Changes Updated 03252022 2022 Contribution Rates will be set on Rate Schedule A due to the passing of HB 144.

Make payments by e-check and credit card The Uplink Employer Self Service System provides you with immediate access to services and information. Equal Opportunity is the Law. The Indiana state unemployment tax is a tax on businesses based on the wages it pays its employees.

Please use our Quick Links or access on the. Take the renters deduction. Indiana also accepts in-person applications at its WorkOne career centers.

Employers paying by debit or credit card should authorize 9803595965 and 1264535957. Up to 25 cash back You can file your reports and payments online or on paper. However DWD also mails report forms to employers.

Pay taxes by Electronic Funds Transfer EFT Establish a new Unemployment Insurance Account. Unemployment Insurance is a program funded by employer contributions that pays benefits to workers who are unemployed through no fault of their own. Select a payment option.

That option is not covered here. Here are your payment options. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

State Unemployment Tax Act SUTA Indiana Code 22 Article 4. Unemployment Insurance is a collaborative federal-state program financed through mandatory employer payments into two separate trusts one administered by the United States Department of Labor USDOL and one administered by the State Workforce Agency which in Indiana is the Department of Workforce Development DWD. This service allows you to pay your Indiana Department of Workforce Development payments electronically and is a service of Value Payment Systems.

Dor Requesting An Extension Of Time To File Via Intime

A Complete Guide To Indiana Payroll Taxes

Set Up State E File And E Pay In Quickbooks Desktop Payroll Enhanced

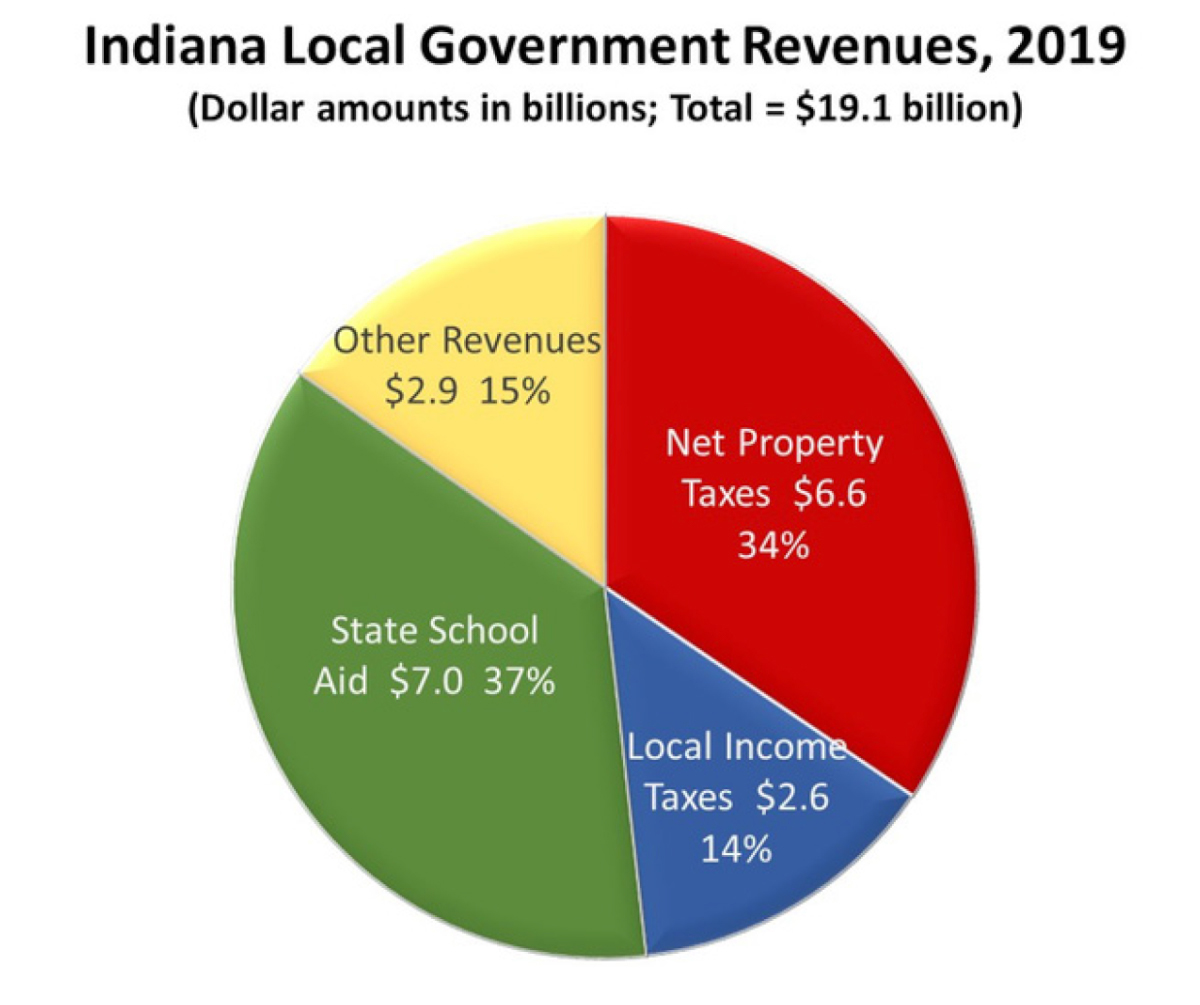

Threats To Local Government Revenues From The Coronavirus Recession Purdue Ag Econ

A Complete Guide To Indiana Payroll Taxes

Indiana Unemployment Eligibility Fileunemployment Org

Stimulus Updates To Know For Summer 2022 Gobankingrates

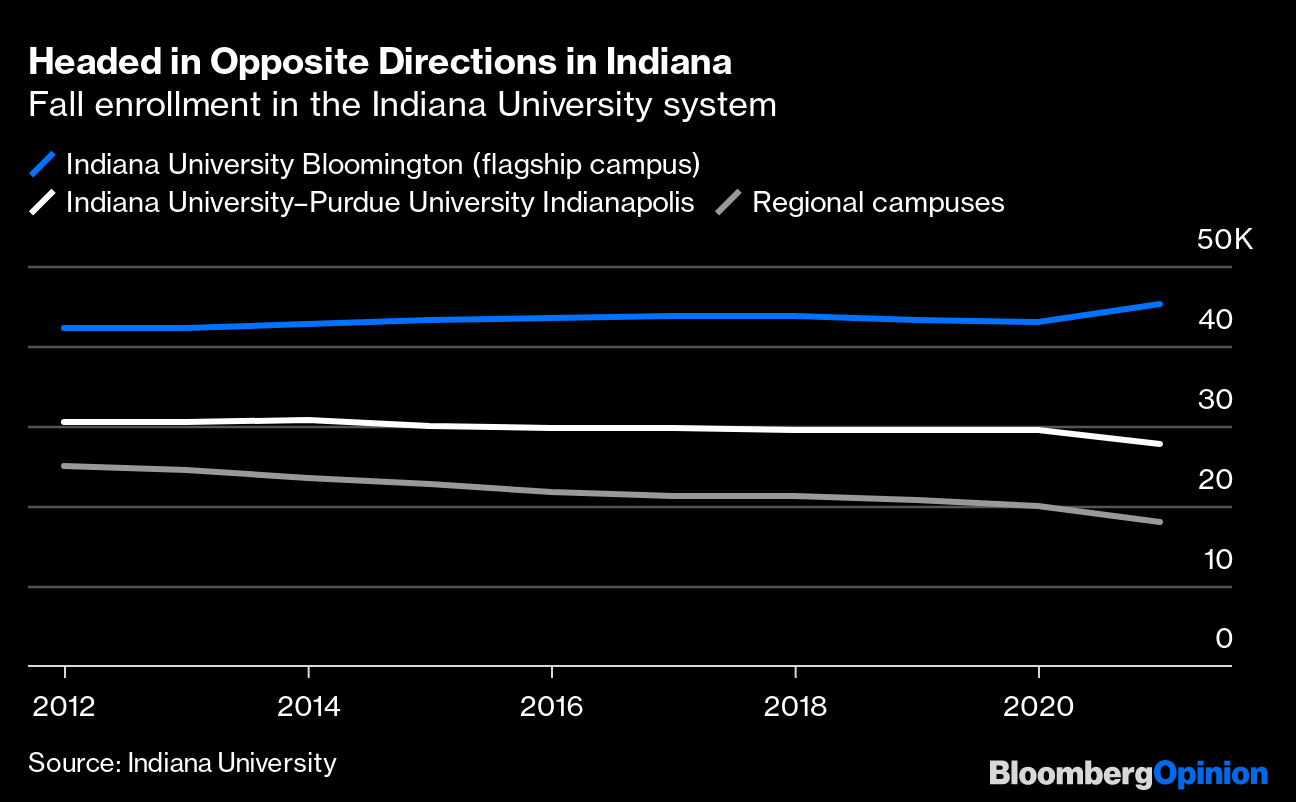

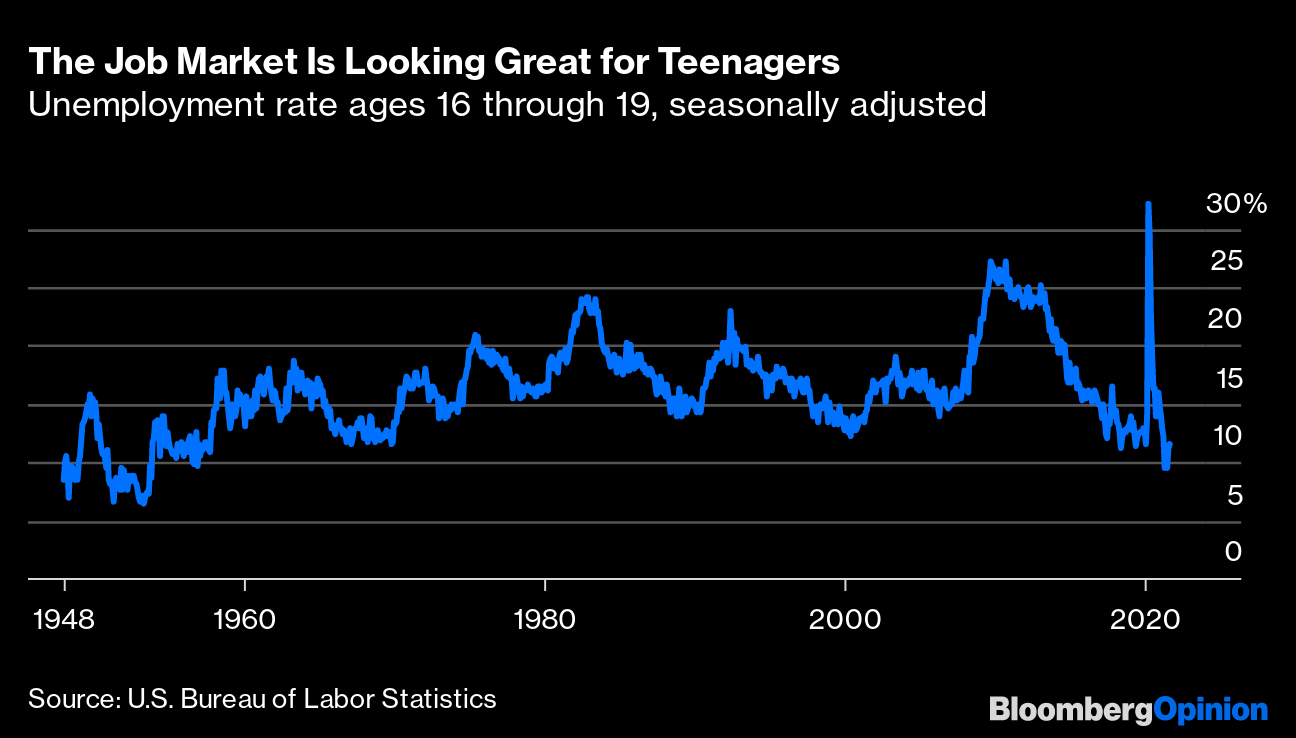

Declining College Enrollment Is A Good Sign For Young People Bloomberg

Dor Check The Status Of Your Refund

2021 Unemployment Benefits Taxable On Federal Returns 13newsnow Com

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

Set Up State E File And E Pay In Quickbooks Desktop Payroll Enhanced

Declining College Enrollment Is A Good Sign For Young People Bloomberg