oregon workers benefit fund tax rate

You are responsible for any necessary changes to this rate. 28 cents per hour.

Tax Structure And Incentives Greater Portland Inc

Oregons trust fund which is on track.

. The funds revenue comes from a cents-per-hour-worked assessment. 33 cents per hour. Employers and employees split this assessment which employers collect through payroll.

The Oregon Workers Benefit Fund may be added to Payroll by creating a Deduction. Go to PayrollData SetupDeductions File. Unemployment tax rates for employers subject to Oregon payroll tax will move to tax schedule three for the 2022 calendar year.

For example The 2017-2018 rate is 28 cents for each hour or partial hour and. Employers are required to pay at least 11. In Oregon the state deposits money collected from state payroll taxes into a trust fund that is used to pay UI benefits to unemployed Oregon workers.

Workers Benefit Fund Assessment Rate Workers Benefit Fund cents-per-hour assessment. OregongovdcbscostPagesindexaspx for current rate notice. To protect and serve Oregons consumers and workers while supporting a positive business climate Workers.

For 2022 the Oregon Workers Benefit fund rate remains at 22 cents per hour worked in 2022. Employers and employees split this assessment which employers collect through payroll. The 2022 Workers Benefit Fund WBF assessment rate is 22 cents per hour.

Note this assessment tax is. 165 cents per hour. Click Add and in Description create Oregon Workers.

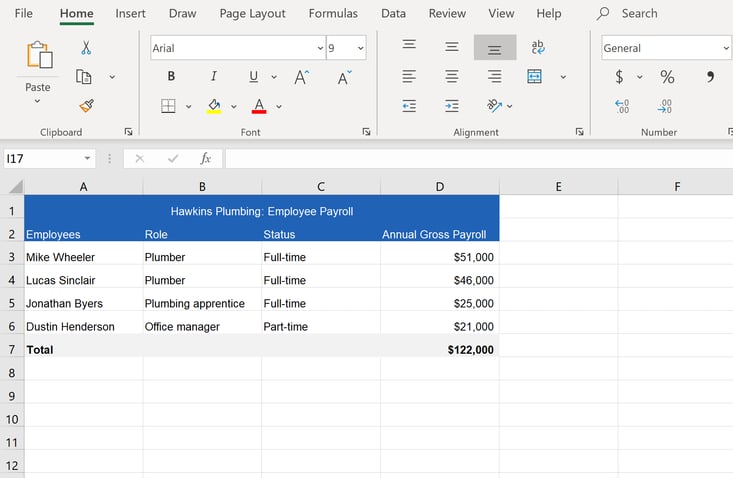

The 2022 payroll tax schedule is a. If you are an Oregon employer and carry workers compensation insurance you must pay a payroll tax called the Workers Benefit Fund WBF Assessment for each employee covered under. Tax Formula Set Up.

No change remains at 22 cents per hour worked in 2022. Go to PayrollData SetupDeductions File. They were sent separately to employers in De-cember of.

10 2021 142 PM. By Jazlyn Williams. For calendar year 2016 the rate is 33 cents per hour this rate has not changed for several years.

The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessmen t is 22 cents per hour worked in 2022 unchanged. Line 10 of the. Workers Benefit Fund assessment.

These programs help keep Oregons workers compensation costs low. Workers Benefit Fund Assessment Rate Workers Benefit Fund cents-per-hour assessment. Go online at httpswww.

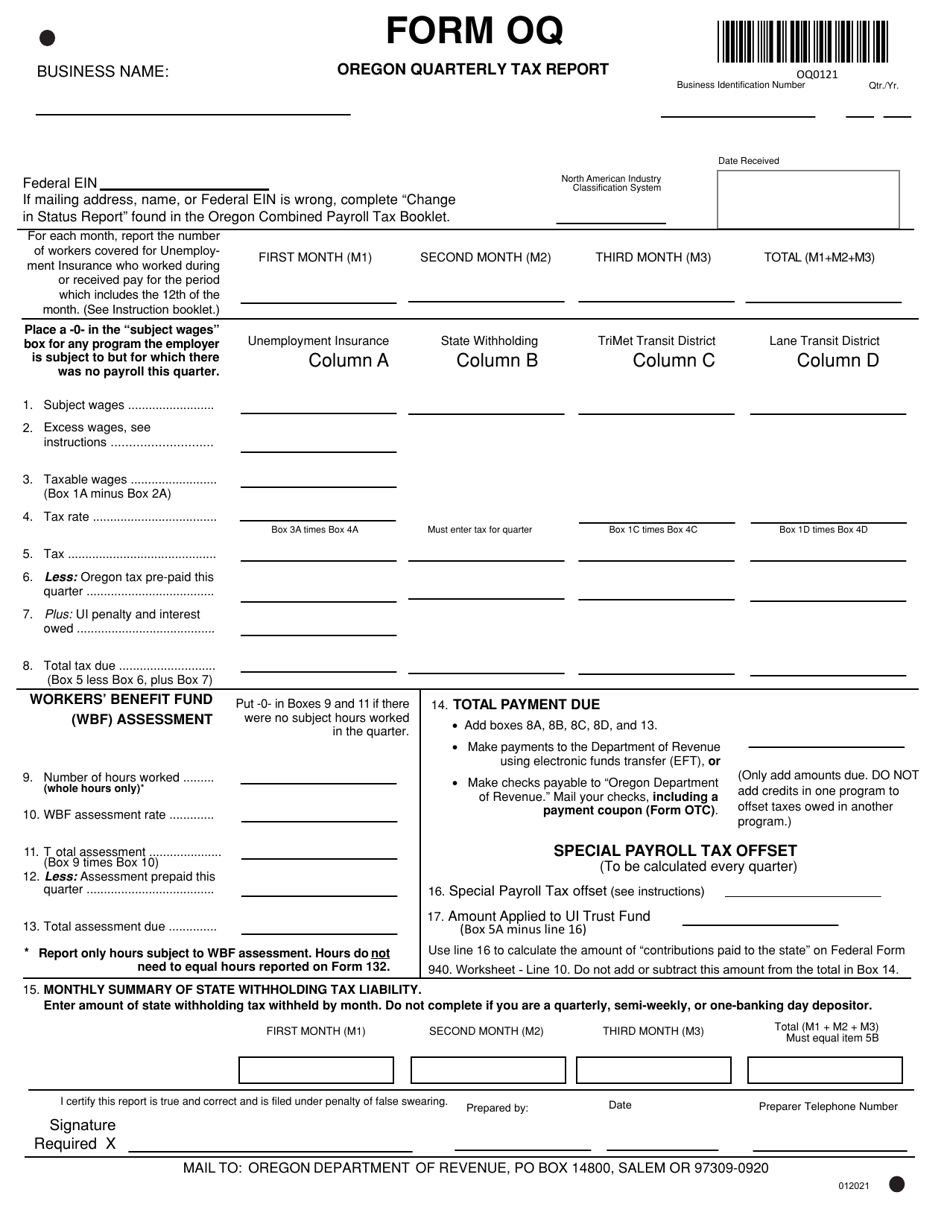

Ment insurance tax workers benefit fund assessment or transit taxes in these boxes. The workers benefit fund assessment rate is to be 22 cents per hour in 2022. Tax rate increased 05 to 10 percentage point will be eligible for deferral only.

WBF Assessment Rate Employers Portion Workers Portion. What is the 2022 tax rate. Additionally an employers UI tax experience rating for 2022 through 2024 will roll back to the pre-pandemic 2020 UI experience rate benefit ratio.

Employers can deduct 11 cents per hour from employees if they choose to have employees pay a portion of the 22 cents per hour employer tax. The assessment is paid directly to Oregons Employment and Revenue departments through quarterly payroll tax reports and the revenue is transferred to DCBS. Employers and workers each pay.

Oregon Workers Benefit Fund Assessment Report. Provides increased benefits over time for. 165 cents per hour.

The Oregon Workers Benefit Fund may be added to Payroll by creating a Deduction. Your tax rates may fluctuate during the 2022. Click Add and in Description create Oregon Workers.

Oregon workers benefit fund tax rate Tuesday March 1 2022 Edit On July 1 2018 HB 2017 the Statewide Transit Tax STT went into effect which requires all employers to. The WBF assessment rate which varies from year to year is xxx cents for each hour or partial hour worked. Employers and employees split the cost evenly 11 cent per hour worked.

Wwwdcbsoregongov Testimony of DCBS Director Our Mission. Oregon Combined Tax Payment Coupons Form OR-OTC arent in this booklet.

How To Calculate Workers Compensation Cost Per Employee

Oregon Workers Compensation Division Do I Need Insurance Employer State Of Oregon

Oregon Workers Compensation Division Do I Need Insurance Employer State Of Oregon

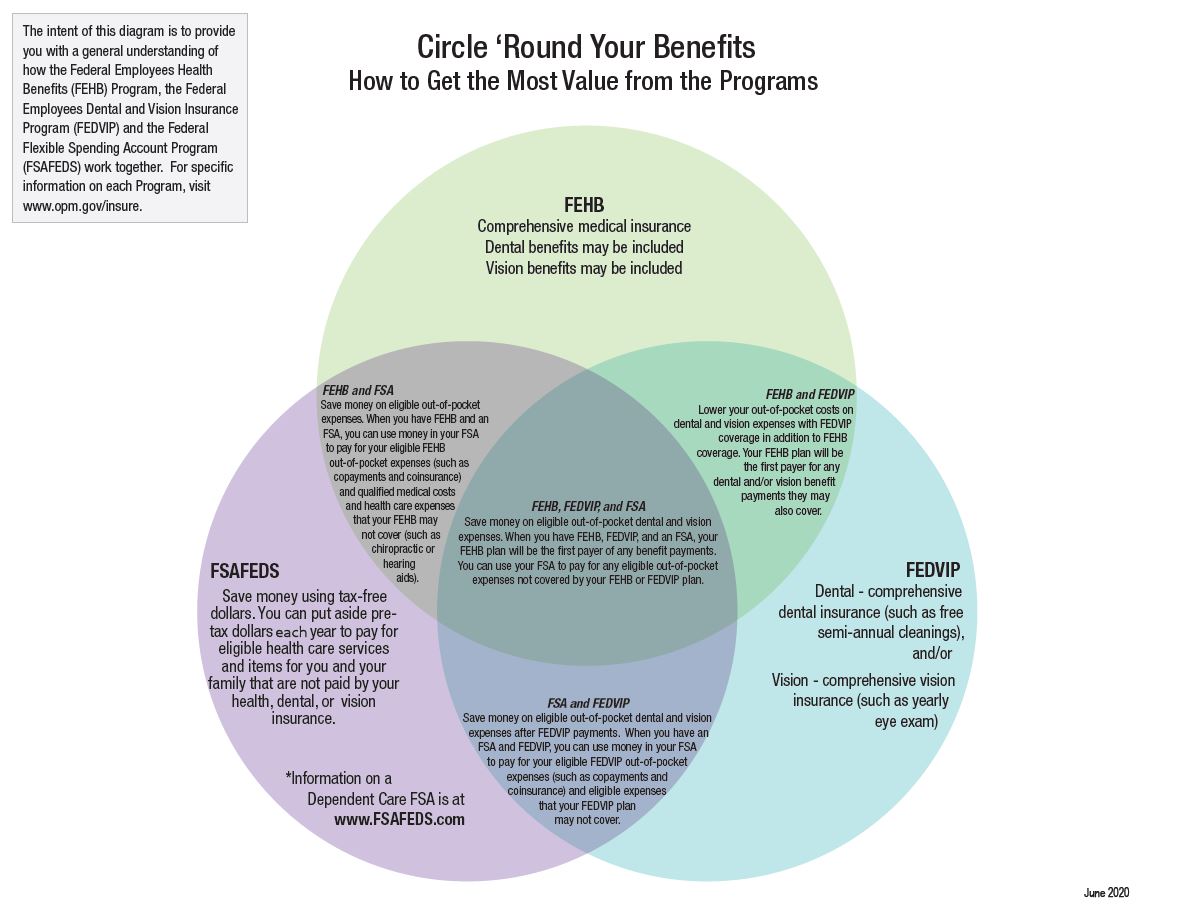

Raising Pay And Providing Benefits For Workers In A Disruptive Economy Center For American Progress

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Trump S Proposed Payroll Tax Elimination Itep

How To Calculate Workers Compensation Cost Per Employee

Oregon Workers Benefit Fund Wbf Assessment

Form Oq Download Fillable Pdf Or Fill Online Oregon Quarterly Tax Report Oregon Templateroller

Is Workers Comp Taxable Workers Comp Taxes

7 5 Million Workers Face Devastating Unemployment Benefits Cliff This Labor Day

What Wages Are Subject To Workers Comp Hourly Inc

How Do You Negotiate A Workers Compensation Settlement Workers Compensation Lawyers Ben Crump

The Long Run Implications Of Extending Unemployment Benefits In The United States For Workers Firms And The Economy Equitable Growth

Employee Benefits Pay U S Department Of The Interior

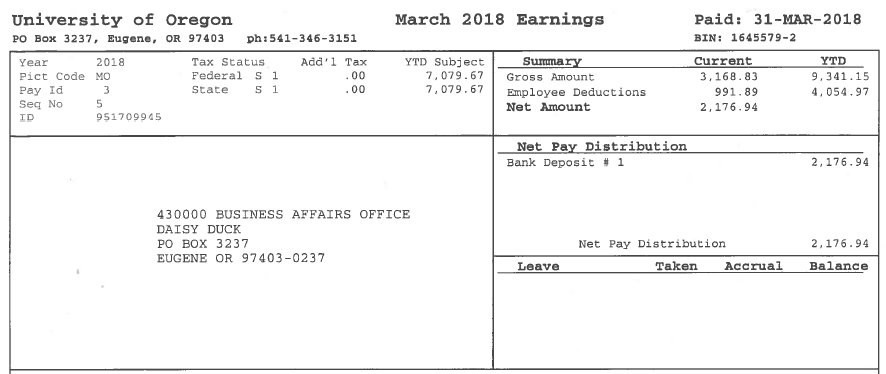

How To Read Your Earning Statement Business Affairs

More Companies Are Wooing Workers By Paying Off Student Debt Money